聯準會最新聲明,為何比想像中還鴿派?美國經濟開始走下坡了嗎?5張圖全解明!

今(21)日凌晨2點,美國聯準會公布利率決議,內容的五大重點包括:1)維持利率2.25%至2.50%不變。2)點陣圖透露今年不再升息。3)再度下調今年經濟、通膨,上調失業率預期。4)確定縮表將採漸進方式於9月結束,機構債將於10月後再投資於美債。5)記者會強調保持耐心,但美國經濟穩健的看法。

整體鴿派態度大幅超出市場預期,M平方整理重點如下:

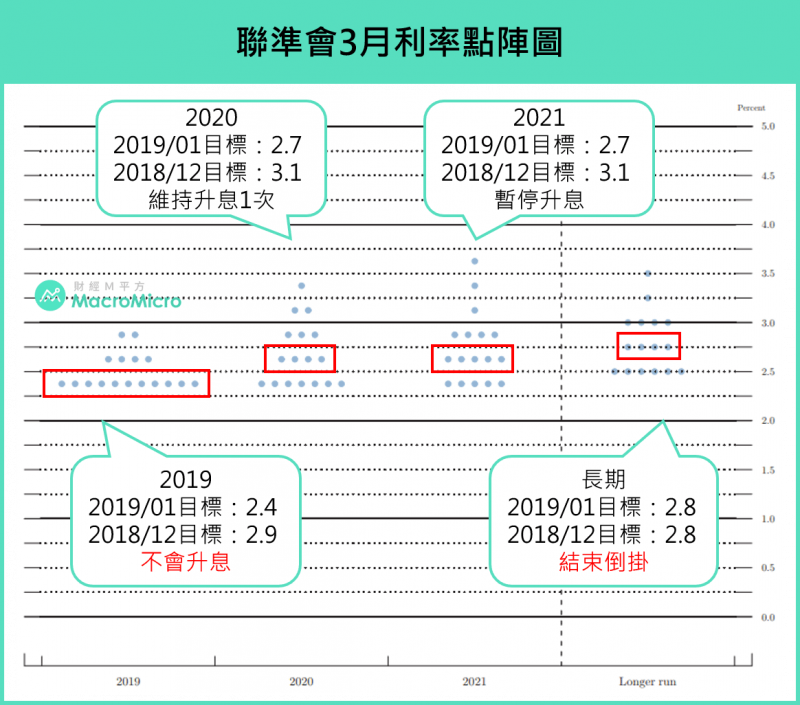

一、聯準會維持利率不變,但點陣圖下調至今年不會升息!

本次聯準會官員全數贊成維持聯邦基準利率不變。而M平方最為關注的今年升息路徑則調整至不會升息!由利率點陣圖可以看出,2019年的目標利率中位數,已下調至2.325%(原2.875%),較12月份下調2碼,且(投票支持)下調(議息委員)人數高達9人!

明後兩年,則分別維持升息一碼、暫停升息,同時長期利率維持2.875%,結束近年來罕見的倒掛現象。整體而言,聯準會再度放緩緊縮路徑,且長期利率首度超過短期,顯示其認為利率已達中性區間水準,利率對於就業與產出將不再有刺激及壓抑作用,未來調整利率與否,將視經濟、通膨狀況而定。(見下表)

聯準會1月點陣圖(圖片來源:財經M平方)

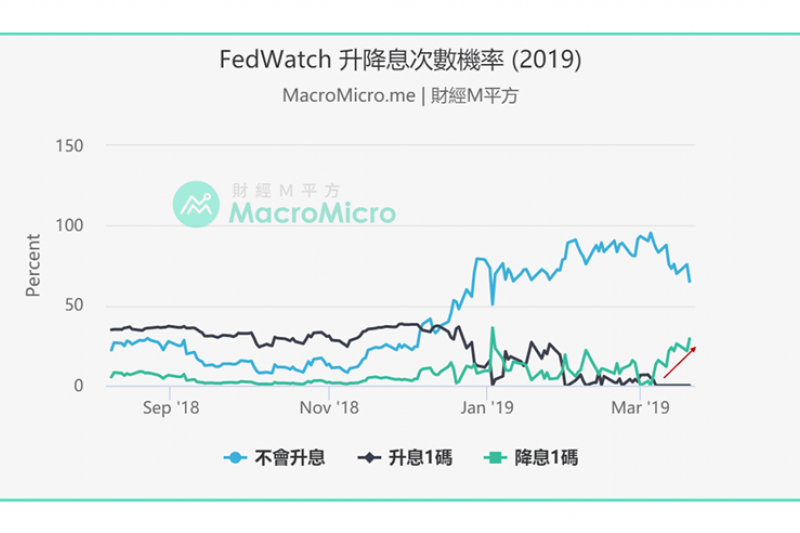

利率會議後,FedWatch顯示2019全年不升息機率自會前75.5%,小幅下滑至63.4%,而降息1次機率自2成附近,上升至3成,鴿派聲浪大作。(見下表)

FED升降息次數機率2019(圖片來源:財經M平方)

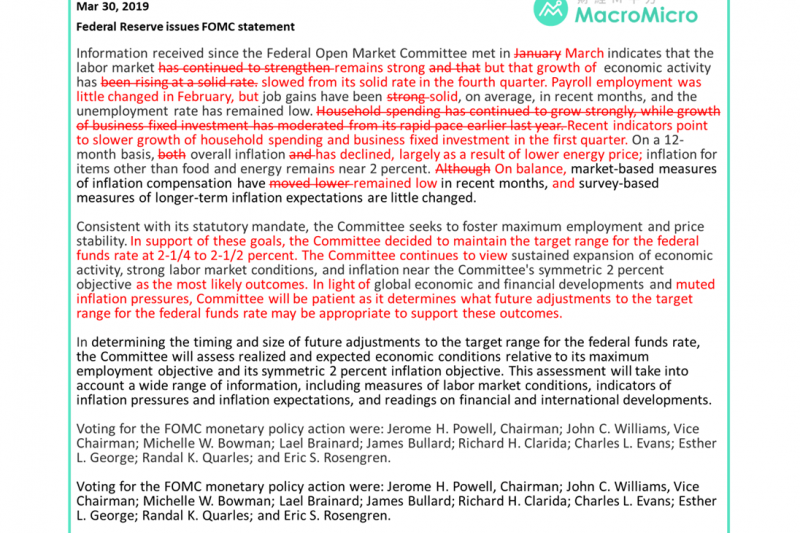

二、聲明稿文字較先前保守

2019年3月份聯準會聲明重點

經濟活動與就業市場:

聲明稿對就業市場敘述自進一步轉強改為維持強勁,並補充敘述2月非農新增就業雖變化不大,但最近幾個月平均增長仍穩健(Strong->Solid),而失業率也維持低檔。另外,經濟活動部分,強調自去年Q4以來的穩健增長放緩(Solid->Slow)。

家庭支出與企業投資:

聲明稿指出近期數據顯示家庭支出及企業投資在第一季有所放緩。 (原文:Recent indicators point to slower growth of household spending and business fixed investment in the first quarter. )

通膨持續下滑:

聲明稿敘述整體通膨下滑,而能源價格依舊是通膨下滑主要原因,並強調基於市場的通膨補償近幾個月一直處於低位。(見下表)

對照先前的聲明,聯準會3月對經濟的說法開始偏向保守(圖片來源:財經M平方)

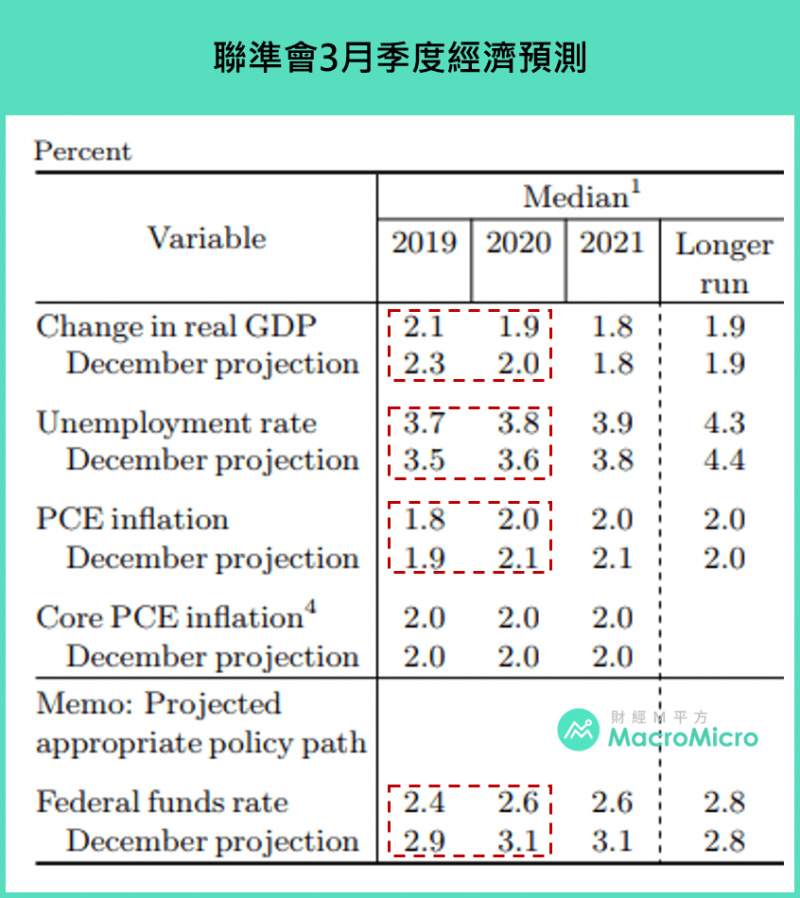

三、再度同步下調今年經濟、通膨預測,並上調失業率

近3個年度(2019~2021) 的觀測值如下。

下調今(2019)明(2020)兩年GDP成長率:2.1%(原2.3%)、1.9%(原1.8%)、1.8%。

上調失業率預估值:3.7%(原3.5%)、3.8%(原3.6%)、3.9%(原3.8%)。

下調PCE(個人消費者支出,計算通膨的標準之一) 預估值:1.8%(原1.9%)、2%(原2.1%)、2.0%(原2.1%)。

維持核心PCE預估值不變 :2.0%、2.0%、2.0%。(見下表)

FED1月季度經濟預測(圖片來源:財經M平方)

四、縮表以漸進方式於9月結束,並宣布10月後機構債到期將再投資於美債!

聯準會2017年10月啟動的資產負債表正常化計畫,採行被動縮表方式,針對兩大資產:美國公債及不動產抵押證券(MBS),每個月逐步減少到期本金再投資。計畫從最初的2017第4季每月回收100億、2018第2季200億,第3季300億等逐季增加100億,以目前最多500億的方式漸進贖回聯準會持有美債及MBS(美債300億/MBS 200億)。至今年Q1預估實際回收金額將達約5345億。截至最新(3月13日)數值,聯準會資產端已減少4,889億至3.97兆,而負債端,尤其是銀行超額準備金已減少6,087億至1.52兆。(見下表)

FED縮減資產負債表的腳步,可望於9月逐步停止(圖片來源:財經M平方)

聯準會縮表不斷地收回流動性,一直是市場最為擔憂的關注重點,本次會議終於發布聲明稿,確定其時間框架以及後續細節,M平方為投資人整理如下:

1) 自5月起降低美債到期贖回的再投資上限至150億(原:300億)

(原文:To ensure a smooth transition to the longer-run level of reserves consistent with efficient and effective policy implementation……The Committee intends to slow the reduction of its holdings of Treasury securities by reducing the cap on monthly redemptions from the current level of $30 billion to $15 billion beginning in May 2019.)

2) 確定今年9月底結束縮表計畫

(原文:The Committee intends to conclude the reduction of its aggregate securities holdings in the System Open Market Account (SOMA) at the end of September 2019.)

3) 長期持有美債組成,繼續實施機構債與MBS的到期贖回

(原文:The Committee intends to continue to allow its holdings of agency debt and agency mortgage-backed securities (MBS) to decline, consistent with the aim of holding primarily Treasury securities in the longer run......any principal payments in excess of that maximum will continue to be reinvested in agency MBS.)

4) 自10月開始,機構債與MBS到期將再投資於美債(限於200億/月以內,購買美債期限與流通在外到期一致)

(原文:Beginning in October 2019, principal payments received from agency debt and agency MBS will be reinvested in Treasury securities subject to a maximum amount of $20 billion per month...... Principal payments from agency debt and agency MBS below the $20 billion maximum will initially be invested in Treasury securities across a range of maturities to roughly match the maturity composition of Treasury securities outstanding.)

5) 縮表結束後,銀行準備金將略高於有效實施貨幣政策水準

(原文:The average level of reserves after the FOMC has concluded the reduction of its aggregate securities holdings at the end of September will likely still be somewhat above the level of reserves necessary to efficiently and effectively implement monetary policy.)

6) 承諾維持總資產規模不變,讓流通貨幣自然增長及準備金逐步降至有效水平

(原文:In that case, the Committee currently anticipates that it will likely hold the size of the SOMA portfolio roughly constant for a time. During such a period, persistent gradual increases in currency and other non-reserve liabilities would be accompanied by corresponding gradual declines in reserve balances to a level consistent with efficient and effective implementation of monetary policy.)

7) 承諾達到貨幣政策有效水平時,聯準會將開始購買資產,彌補非儲備負債端的增長,並保持適當的儲備水準

(原文:When the Committee judges that reserve balances have declined to this level, the SOMA portfolio will hold no more securities than necessary for efficient and effective policy implementation. Once that point is reached, the Committee will begin increasing its securities holdings to keep pace with trend growth of the Federal Reserve's non-reserve liabilities and maintain an appropriate level of reserves in the system.)

五、記者會重點摘要:強調目前美國經濟穩健,提及海外趨緩

1) 強調未見到數據支持聯準會改變保持耐心立場,12月消費數據疲弱、通膨依舊溫和為暫緩調整利率主因。

(原文:We don’t see data coming in that suggest that we should move in either direction. They suggest that we should remain patient and let the situation clarify itself over time.)

(原文:I don’t feel that we have kind of convincingly achieved our 2 percent mandate in a symmetrical way……That gives us the ability to be patient, and not move until we see that our target goals are being achieved.)

2) 雖然2018年美國經濟沒有放緩跡象,但海外經濟趨緩,尤其中國、歐洲,而今年以來美國數據好壞參半。

(原文:growth has slowed in some foreign economies noddle notably in Europe and China……while the US economy showed little evidence of slowdowns, through the end of 2018……the limited data we have so far this year have been somewhat more mixed.)

3) 預計聯準會總資產負債表規模將為GDP的 17% (約3.5兆~3.7兆)

(原文:the balance sheet will be of a size of approximately 17% of GDP around the end of this year down from 25 percent of GDP in at the end of 2014.)

文章來源:【FOMC會議】比想像中還鴿! 3月聯準會放出大絕招!

轉載自財經M平方

相關報導

● 還在猜美股何時創新高?聯準會不說的事,更值得你擔心:全球經濟腳軟啦!

● 為什麼川普急著跟習大大敲定協議?答案揭曉:聯準會鬆口:美國經濟今年度小月!

Yahoo奇摩新聞

Yahoo奇摩新聞