8-4/DBS Unjustly Cancels Card, Nullifies Over 470,000 Frequent Flyer Points Cheng,Cheng-Chien Calls for Regulatory Action

By Alexander Chiu, Journalist of CNEWS, Taipei

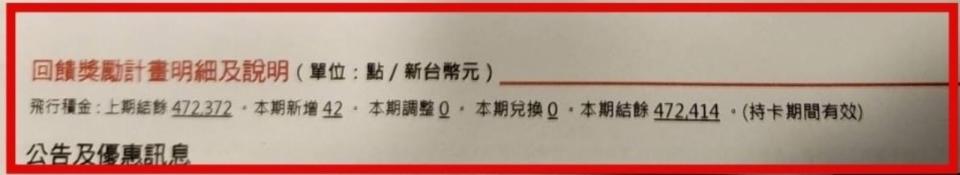

CNEWS received a complaint regarding DBS “World Flyer Card” holders whose credit card was canceled, and his accumulated 472,414 frequent flyer points nullified without a reasonable explanation from the issuing bank. Legislator Cheng,Cheng-Chien stated that consumer rights must not be infringed upon and that the Financial Supervisory Commission (FSC) should strictly enforce compliance by financial institutions. He highlighted that he had received similar complaints before, indicating that this is not an isolated incident. The FSC should thoroughly investigate whether the issuing bank violated any regulations in handling credit card disputes and, if so, take legal action to prevent such situations from recurring.

Mr. W, the complainant, applied for a DBS World Flyer Card in 2019, and it was issued on August 5 of the same year. Four years later, on November 16, 2023, Mr. W’s credit card was abruptly canceled without warning, rendering his 472,414 accumulated frequent flyer points worthless.

Mr. W stated that he paid his annual fees on time and settled his card bills every month, making DBS Bank’s decision to cancel his card incomprehensible. Despite numerous attempts to contact DBS Bank for clarification, he received no satisfactory response. He added that the sudden cancellation of his card by DBS Bank caused his insurance premiums, which were automatically charged to the card, to go unpaid, severely damaging his credit and leaving him with no recourse. This has deeply disheartened him.

Cheng,Cheng-Chien pointed out that according to the “Regulations Governing Institutions Engaging In Credit Card Business,” the standardized credit card contract of the issuing institution must comply with the relevant provisions of the “Standard Form Contract for Credit Cards” to ensure consumer rights are protected. Article 23 of this standard contract stipulates that the issuing institution can only terminate the contract by written notice to the cardholder under specific conditions, such as card expiration, continuous default, property being subjected to court enforcement, or other serious credit issues.

Referring to the complainant’s case of spending over NT$8 million in four years with a good credit record and no late payments, Cheng,Cheng-Chien believes that the abrupt card cancellation and forfeiture of over 470,000 points clearly violate the regulations protecting cardholder rights. The FSC has repeatedly instructed issuing institutions to safeguard cardholder rights. Sudden card cancellations and confiscation of accumulated points or rewards are unfair to consumers.

“I have received similar complaints, indicating this is not an isolated incident,” Cheng,Cheng-Chien emphasized. He urged the FSC to thoroughly investigate whether the issuing banks violated any regulation in handling credit card disputes and, if so, take legal action to prevent such situations from recurring.

“If a bank unjustly cancels a card in violation of the FSC’s standardized credit card contract, affected consumer can file a complaint with the FSC,” Cheng,Cheng-Chien stressed, and insisted that consumer rights must not be infringed upon and that the FSC should ensure financial institutions comply with regulations to fully protect every consumer’s legitimate rights.

Legislator Lo Chih Chiang added that points and rewards are consumer rights, and banks must communicate with consumers in case of any incidents causing consumer loss. He noted that the FSC had previously required issuing institutions to protect cardholder rights during card clearing, which usually involves the bank managing long-unused cards. If a bank perceives a credit risk, it should promptly inform the cardholder, as unauthorized card cancellations may cause unnecessary harm.

Lo Chih Chiang emphasized that for benefits and rights arising from credit card use, such as unused or unexpired bonus points, miles, and rebates, banks should help cardholders redeem or use them quickly instead of unilaterally confiscating them without warning. This practice is evidently unfair to consumers.

Photo Source: CNEWS File photo

《More CNEWS reports》

【In case of article forwarding, please cite the source】

Yahoo奇摩新聞

Yahoo奇摩新聞